Before choosing a system, talk to your insurer to see what their restrictions have to do with what type of systems make the discount rates. deductible. Some companies need totally kept an eye on protection systems, while others just need a Wi-Fi system with self-monitoring. The savings on the insurance policy premium can considerably balance out or cover the expense of the protection system, so you get 2 benefits for one expense.

If you live near a station house, very first -responders will certainly arrive swiftly at your residence in instance of a fire and can contain as well as extinguish the fire quickly and also efficiently, reducing damages as well as reducing the expenses to tidy up - affordable. Therefore, your costs might be lowered in recognition of the decreased danger.

Coastal homes are attractive as well as relaxing, but they feature added risk: Any type of body of water is a flood danger. Whether it's an attractive stream, a serene lake, or a sea in your yard, distance to water will certainly boost your insurance coverage rates. liability insurance. Standard homeowners insurance does not cover damage from floodings that are outside the house.

Even if your residence isn't in a waterside or low-lying location, flood insurance coverage can be an excellent financial investment if the water level in your area are high. The water isn't the only risk to a seaside residence. Coastal locations are extra exposed to strong, harmful winds, and salt spray can trigger steel and also wood to age quicker as well as fall short faster, so those dangers also produce higher prices - deductibles.

Your credit report score may also affect your property owners insurance coverage plan premium. House owners with lower credit history ratings may have to pay more simply since the insurance provider regards them as a bigger danger; while this is not necessarily real, it's a truth of the insurance market. for home owners insurance. Those with greater scores might pay much less.

An Unbiased View of 7 Features That Drive Up Homeowners Insurance Costs

This is how they earn money. They recognize, of training course, that in some cases claims necessity be submitted as well as will not always hold that against you. If, nonetheless, you're a constant fileryou file a claim for every single stick that jumps off the roof and also every decline of water from a pipeyou may locate that the reduced rates are not readily available to you (affordable).

Especially damaging are numerous claims of the same kind. Your rate will not be significantly influenced by one weather condition claim, since that's what homeowners insurance policy is for. A fire case will have a slightly larger result, yet a second fire case (or 2nd or third burglary claim) recommends to the insurance firm that you aren't making use of ideal security precautions and go to a greater danger for future insurance claims.

Unless your backyard is completely fencedand in some cases even thenthose structures can be categorized as attractive annoyances. Every child that passes by will be attracted to the frameworks, as well as that makes them a threat (insurance companies). As much as we wish to believe that all youngsters are accompanied by moms and dads when walking the area, they're kids, so slipping over to attempt out the next-door neighbor's trampoline or water slide in a vulnerable minute might be tempting.

Attractive problems aren't restricted to play frameworks, either. A recurring construction task with the pledge of a trendy location to play hide-and-seek, or for grownups, the assurance of tools and also fascinating novelty, can pull in unexpected or uninvited visitors and create a greater rate. Flood insurance policy is a policy that is often added to your base policy.

If your pet dog gets on the restricted list, you can add an endorsement to consist of coverage of that dog. If the replacement price of great jewelry in your residence might exceed the optimum payment from your plan, whether it's an interaction ring or grandmother's antique breastpin, you can include a recommendation to cover the distinction - a home.

Average Home Insurance Cost - Everquote - Questions

Every one of these enhancements have an expense, so making great decisions concerning what is covered, what needs to be covered, and what the protection restriction requires to be will certainly aid you reach the very best equilibrium for you - insurance discount. Where you live can make a substantial distinction in your plan cost.

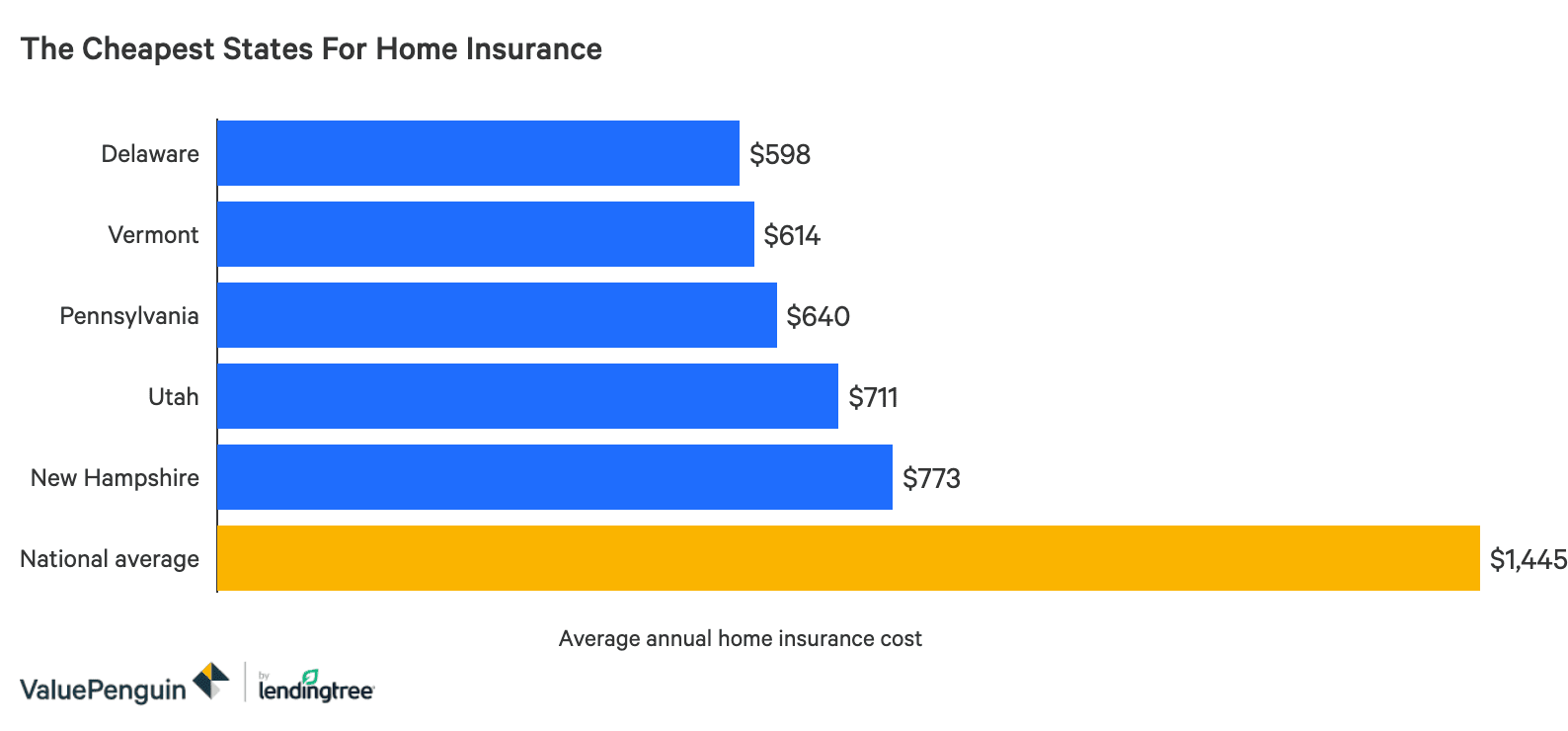

Numerous states have their very own insurance coverage standards that identify just how much insurance coverage you should lug to protect their own funds in case of an all-natural disaster, and also those regulations will fold right into your costs. If you live in a state that is much from where structure materials are generated, those products will set you back extra in a repair or restore.

As with any other carrier, service provider, or lender that you choose to do organization with, it is important to do your homework. Even if your loan provider or realty agent offers you the names of a couple of insurer doesn't imply those companies are ideal for you. Ask family and friends, search online, make call, request for quotes, as well as check business records of firms you're taking into consideration. insurance.

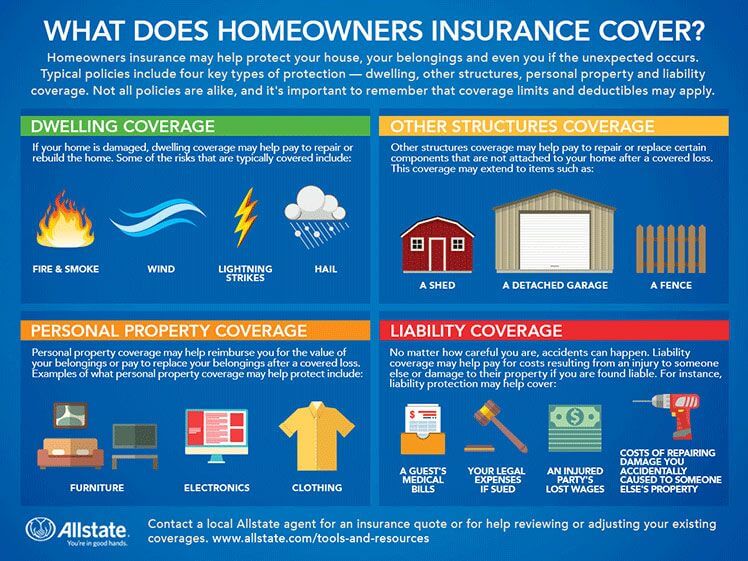

Named-peril protection is restricted to the specific risks provided in the policy, with any type of other hazards left out. Open up danger is the opposite: All risks are covered, unless they are especially provided as exclusions. This can be a little complex, so it's vital to read your strategy files carefully and also ask your insurance company for explanation before signing.

The most extensive coverage choice, HO-5 coverswell, whatever that is not omitted. It includes coverage for all risks that are not called as exemptions (such as damage triggered by forget) for your residence, sheds, as well as personal effects - insurance discount. Aimed at condo owners, that have various needs from both homeowners and also occupants, HO-6 provides named-peril protection for damage to the interior, personal effects, individual obligation, as well as guest clinical settlements, in addition to loss of usage as well as additional living expenses, however it does not cover the structure of the building.

The 10-Minute Rule for The General® Car Insurance - Get A Quote To Insure Your Car

It has a various collection of specifications, nonetheless, as it's planned for mobile home dwellers and also includes protection that specifies to produced and mobile houses. Has your residence been decreased for property owners coverage due to the fact that it's also risky? HO-8 coverage will certainly list the particular perils you're covered for and give hazard insurance coverage just for your house and also individual things.

Even if you don't have a home mortgage, a home and also yard that are uninsured resemble an invite to bankruptcy and also economic wreck. It's terrific to have a reserve for unanticipated repair work and upkeep, yet the majority of people do not have the sources to pay out of pocket for a residence that is entirely ruined by fire or collapseespecially when you think about the cost of the preparation, permits, teardown and also carry away of the former house, products, home furnishings, and also all of the personal effects that was shed, together with the cost to live elsewhere for months while the rebuild is completed.

Ask about packing your house owners policy with life insurance policy as well as car insurance policy at the same insurance provider. Typically bundle deals are offered for multiple lines of insurance policy. Collect at the very least three house insurance coverage estimates to contrast insurance coverage and also price. Currently that you're acquainted with the ins and outs of house owners plans, you remain in an excellent position to ask your representative specific concerns to make certain that you're getting the insurance coverage you need at the very best price you can. cheap homeowners insurance.

It's crucial to both the protection of your residence and also pocketbook to ask concerns and also make sure you actually obtain the insurance coverage you require. Right here are responses to some of the most common inquiries and their solutions (insurer). The nationwide average is $1,300 to $1,500 per year, yet this will vary significantly based upon area, the dimension as well as specifics of your house, and also just how much insurance coverage you elect.

Are https://s3.us-west-1.wasabisys.com there property owner insurance price cuts? Discounts exist, but it's not as deal-driven as various other kinds of coverage like auto insurance.

The Facts About Average Cost Of Homeowners Insurance 2022 – Forbes Advisor Uncovered

Multiple Qualities. Package proprietor insurance for all your services with the very same firm to decrease your premium on each plan. Does my home owner's insurance coverage cover my rental property? It depends. Respond to how typically you rent the residential property and the length of time people remain to choose what sort of insurance policy you require.

Some confusion comes from the truth that property manager insurance policy is occasionally called rental home insurance. Rental residential property insurance policies cover residences, and renters insurance coverage protect your tenants' individual possessions as well as obligation. home insurance. Lots of property managers need their occupants to acquire occupants insurance coverage because it reduces frustrations when personal effects cases emerge.

deductible homeowner insurance for home condo insurance for home

deductible homeowner insurance for home condo insurance for home

And proprietors request lessees get renters insurance policy to safeguard the lessees after a major claim. Allow's return to the fire instance. liability insurance. If the tenant had to move till repair work were completed, how would they spend for living expenses? The tenant's policy would cover that for them, while your proprietor insurance policy compensated you for your loss of rental income while the house is made habitable.

This 3,700 square-foot apartment with three rentals lies near midtown Chicago on Fullerton Opportunity. inexpensive. It last cost $950,000 in 2018, as well as the owner thinks its substitute expense would certainly be about $740,000 at $200 per square foot. It's completely leased and generating a monthly rental revenue of $6,000.

Last, the liability insurance coverage costs $350 for $1m in obligation security as well as $5,000 in medical settlements for lessees and also their guests. What's wrong with this instance, The owner thinks that his proprietor insurance protection safeguards against almost anything that can occur to his residential property, as well as he remains in good condition.

Some Known Facts About 6 Ways To Dramatically Lower Your Home Insurance Costs - Cnbc.

low cost homeowners insurance homeowner's insurance cheap homeowners insurance home insurance and home insurance

low cost homeowners insurance homeowner's insurance cheap homeowners insurance home insurance and home insurance

As an example, let's claim the owner installed a roof, and it costs $40,000 that's the substitute price. He installed the roof in 1999, so by now, it's racked up $18,000 in devaluation. The Actual Money Worth is now only $22,000; that's the substitute cost of $40k minus $18k in depreciation.

low cost homeowners insurance homeowner insurance affordable homeowners insurance for home owners insurance affordable

The proprietor must probably get a brand-new quote where the assessment method is "Substitute Cost" instead of "Actual Cash Money Worth."A Pointer For Future Landlords, We spoke with a genuine estate financier and he shared an insight on just how he uses property manager insurance for the residential or commercial properties that he refurbishes that he leases out to tenants in the future.

You require what is called a vacant plan which as you can think of is more expensive because statistically, an uninhabited residential property is far more likely to sue. We utilize an uninhabited plan after we have actually finished building and construction and also are waiting to put a renter. After the occupant has relocated in we convert the policy to a property manager plan which is more affordable. insurance premiums.

Unless you function in the insurance coverage market, you most likely have a great deal of concerns about acquiring a homeowners insurance coverage plan. Comprehending even more about your choices, exactly how insurance policy business operate and exactly how home insurance policy estimates job helps you obtain the very best feasible bargain. homeowner's insurance. The typical homeowners insurance coverage is fairly intricate, however buying one doesn't have actually to be complicated.

landlord cheapest homeowners insurance cheaper homeowners insurance for home insurance credit

landlord cheapest homeowners insurance cheaper homeowners insurance for home insurance credit

, gathering relevant information like quotes and also examining your options. While some of the adhering to factors might not apply to you, this house insurance policy guide offers a generalized strategy to assessing and selecting the ideal residence insurance coverage for you.

The Main Principles Of Average Cost Of Homeowners Insurance (2022) - Quotewizard

The basic home owners insurance plan additionally protects the homeowners from liability. Their home mortgage lending institution requires that they bring it, They require liability security, They require a way to rebuild or fix their house after devastation by a covered cause like a fire, They need a way to change their belongings if they're damaged by a covered cause or stolen, Without house insurance coverage, proprietors could deal with high repair work expenses.